2003

Is Not Going To Be a Good Year

for Doctors

By David Gibson, MD

Introduction

Beginning

in January 2003, physicians in private practice will begin to experience a

precipitous drop in their office cash flow. They will see an explosive

increase in their accounts receivables and they will witness an uncontrollable

accumulation of uncollectible debt.

It

is now universally recognized that the “wheels are coming off the wagon” for

America’s employer based underwriting system for health care.

Seventy-five percent of all U.S. adults under age 65 get their health insurance

through the workplace. The LA Times

recently editorialized that “the growth in health-care premiums and in the

numbers of people without insurance represents an economic drag that business

cannot long endure and a level of unnecessary suffering a civilized nation

cannot in good conscience allow.”

Employers,

stunned by double-digit increases in health insurance premiums, are desperate

for cost-stabilizing alternatives. Here is the political reality that is

emerging. If the high deductible indemnity products, described in this

article, that are now being embraced by employers do not stabilize cost trends,

employers will simply no longer support the current private health care

underwriting system. The combination of a business/labor coalition coupled

with the usual entitlement expanding choir (the American Association of Retired

Persons and the Democratic Party) will represent an unstoppable political

tsunami that will produce a national single payer system similar to Medicare.

Health

care cost trends

Clearly,

health-care costs have taken a dramatic turn for the worse during the past five

years, rising more than 50 percent, with no end in sight. As a result, employers

consider this unrelenting rise their most serious business problem and they are

responding.

Large

employers have been stunned by a twelve-fold health-care premium increase in the

last decade. These companies

will spend an average 15 percent more on the cost of health coverage for

employees next year, according to a study recently released by Hewitt

Associates. The cost of health

insurance for large employers will increase 15.4 percent in 2003, compared to a

13.7 percent rise this year. Health insurance premium rates for HMOs will

increase 16 percent, and those for preferred provider organizations will

increase 15 percent, the study found.

Forty-six

million Americans work for small employers. These individuals typically

have less access to coverage than those in large firms. California small

to medium sized employers generate over half of all jobs. They have been

receiving premium increases for 2003 that run up to 60 percent.

Where

is the market going?

During

the last price spiral in late 1980s, employers turned to managed care, but the

latest round of health inflation has exposed the folly of its claims to control

costs. There is now a growing momentum away from “first dollar

coverage” managed care plans. HMO enrollment shrank by 640,000 this past

year with the trend accelerating into this year and beyond. In fact, other

than government employees covered under union bargaining agreements, no insurer,

other than Kaiser, is selling new HMO accounts in California today.

As

a result, managed care is both consolidating and imploding. All of the

regional health maintenance organizations (Omni, Health Plan of the Redwoods and

Lifeguard) have exited the market. By the end of 2002, California will

have 17 HMOs writing commercial policies, down from 21 in March.

Employers

are embracing indemnity products with high deductibles in an effort to align

inflationary rates for health care benefits with wages. Deductible limits

for PPO products increased 37 percent in 2001 according to the data published by

the Kaiser Family Foundation. Market data indicates that the deductible

has been increasing exponentially during this year and beyond.

To

monitor the dynamic movement of the health underwriting market, one must visit

with the employers who make payroll each month and the brokers who work directly

with them. Over the past several weeks, I have had the opportunity to

engage many of these individuals in informative conversation. The

following summarizes the profound restructuring of the health care underwriting

system they indicate is now well underway here in California and across the

nation.

The

dominant product now being embraced by the small to medium sized employer market

is high deductible ($1,000 per year with a $2,000+ out of pocket beyond the

deductible) catastrophic health insurance. The policy covers hospital

services only. Office visits are not covered. In patient

professional fees are covered at 20percent of the negotiated fee after the

deductible. There is no pharmacy benefit.

Employers

can choose to purchase “wrap products” that will enhance the catastrophic

product’s coverage. These wraps limit their liability for drugs and or

ambulatory professional services typically at $500 per year per beneficiary.

The

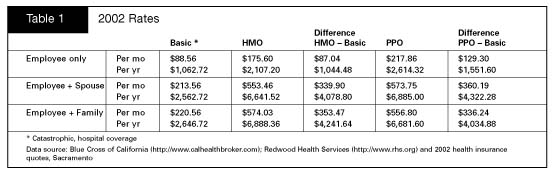

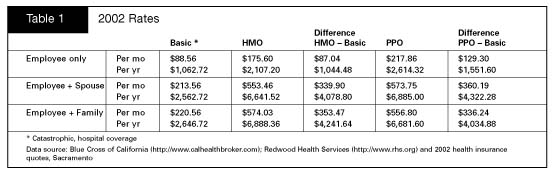

following table summarizes how this indemnity catastrophic coverage product

compares with existing managed care products this year.

The

just completed legislative session here in Sacramento produced a string of

successes for the Democratic Party's core constituent groups. As a result,

California’s employers are facing significant increases in their costs for

doing business. Governor Davis has signed legislation that mandates

increases in workman’s compensation, altered existing labor law and enriched

family leave benefits.

All

insurance costs from liability to fire and casualty have increased. Now

employers face continued significant increases in health benefits. The

differential per year between the catastrophic or basic product described above

and the HMO product is a $1 thousand per employee and $4.2 thousand per-family.

For PPO products the differential is $1.5 thousand and $4 thousand respectively.

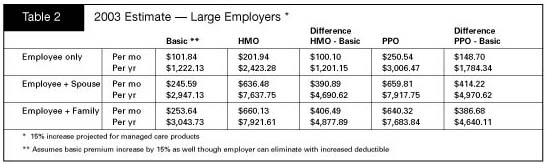

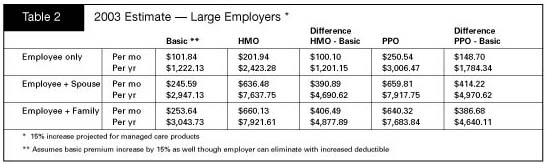

The

cost differentials for 2003 that are now being quoted to large employers are

summarized as follows:

Large

employers are facing 15percent trends in their health premiums. This

produces annual cost differentials for the HMO vs. the catastrophic product of

$1.2 thousand for the individual and $4.8 thousand for the family. The

differential for the PPO product is $1.78 thousand and $4.64 thousand

respectively. It should be noted that the employer can avoid premium trends

beyond the general inflation rate for the catastrophic product by adjusting

upward the deductible limit.

The

following table demonstrates the reason for the rapid movement to catastrophic

by the small to medium employer market. These employers are facing

60percent increases in their group health premium costs for 2003.

Thus,

the small to mid sized employer that generates over half of all jobs in

California faces a cost differential next year between the catastrophic and the

HMO product of $2.15 thousand for the employee and $7.97 thousand for family

coverage. The differential for the PPO product is $2.96 thousand and $7.65

thousand respectively.

Physicians

are small employers. Their options next year are rather limited.

They can either drop coverage for their employees or absorb the increases

summarized above. The option of moving to a catastrophic product will be

hard to resist.

Uwe

Reinhardt, PhD, professor of health economics, Princeton University, sees an

evolving trend whereby employers, health insurers and the government are all

intent on pushing more health care costs onto consumers, a situation he expects

could create an enormous backlash against doctors and hospitals over the next

two to three years.

The

implications of a high deductible indemnity insurance product on the

physician’s practice

The

high deductible indemnity products that are now cannibalizing the market during

the current open enrollment season for 2003 coverage will have profound effects

upon the physician’s practice. Unless the altered business fundamentals

these new products bring to the market are factored into the physicians business

planning for next year, the physician will likely experience significant

reductions in cash flow, run-away accounts receivables that will never be

collected and an inability to meet business obligations.

If

you now have a significant portion of your revenue generated by capitation

contract; then prepare in advance for a substantial cash flow reductions. The

following cautionary tale is illustrative. At the time of writing this

article, the San Jose/Good

Samaritan Medical Group, the largest doctors' group in the South Bay, has just

announced bankruptcy.

The

San Jose Medical Group, founded in 1955, is a cornerstone of Silicon Valley

health care, at one point serving more than 170,000 patients. In recent years,

it has faced mounting financial problems due in part to declining reimbursements

from health insurers and the federal government. Those problems were exacerbated

by a sharp decline in the clinic’s capitated HMO patients, from 90,000 in 2001

to 60,000 in 2002.

Going

into a capitation contract is profitable. An individual physician or

medical group enjoys increased cash flow resulting from first of the month

capitation checks along with residuals from their previously developed accounts

receivables.

Coming

out of a capitation contract is another matter. Cash flow is immediately

reduced when the capitation checks stop and it takes 60 to 90 days to receive

payment from accumulated accounts receivables. This reality is at the core

of the San Jose Medical Group’s

bankruptcy.

Carefully

evaluate the liability associated with your network (IPA) contracts. Network

contracts, the staple of managed care, do not translate well into the high

deductible indemnity market. You may have many more of these contracts

than you realize. There is a vigorous secondary market where these

contracts are bought and sold on the national market. These contracts

dictate that the physician can only collect co-payment funds from the patient

after the claim has been adjudicated by the insurance administrator.

Unless the employer has purchased a wrap product, the catastrophic policy

contains no liability for professional services in the ambulatory setting.

Thus

the physician is bound by contract to provide service but can not collect until

the carrier confirms non-coverage. The likelihood of the physician

collecting from the patient will significantly decay after a 60 to 90 day

adjudication cycle.

Payment

at the time of service or arrangements for payment over time is an absolute

requirement for financial survival in the coming business environment for

physicians. Continuing to perform services under your existing IPA

contracts will only guarantee an out-of-control accounts receivable and

ultimately insolvency for the physician’s practice.

Invest

in your front office staff. You will need someone who can provide financial assistance to your

patients as they receive your unexpected bills for professional services.

This front office financial assistant must be able to set-up payment

arrangements for patients lacking the funds to pay for the services they

receive. The very survival of your practice depends upon the interpersonal

and financial skills of this individual.

Develop

a close business relationship with your bank. Physicians should not be in the business of consumer debt financing.

Work with the bank to have them rate debt, assume these consumer debt

liabilities and manage the collection process.

Conclusion

The

"managed care'' revolution in the 1990s transformed health care delivery by

imposing a leaner, meaner approach to business. Tough economic times now

threaten the most financially fragile health care businesses which include most

physicians’ practices.

Physicians are both health care professionals and small business men & women. The very fundamentals of the business of medicine will change dramatically beginning in January, 2003. To not recognize this reality is to invite insolvency for both individual and group practices in the immediate future.

© David J. Gibson, MD 2002